Sbobet adalah pilihan tepat bagi orang yang suka berjudi dan ingin bermain game online. Situs https://woodcreekbarandgrill.com webnya memiliki banyak pilihan permainan dan tersedia dalam beberapa bahasa. Selain itu, ia menawarkan berbagai opsi pembayaran.

Sebelum bertaruh pada permainan atau tim, pastikan untuk memahami aturan dan strateginya. Penting juga untuk mengetahui bentuk dan status cedera pemain atau tim saat ini.

Mudah Digunakan

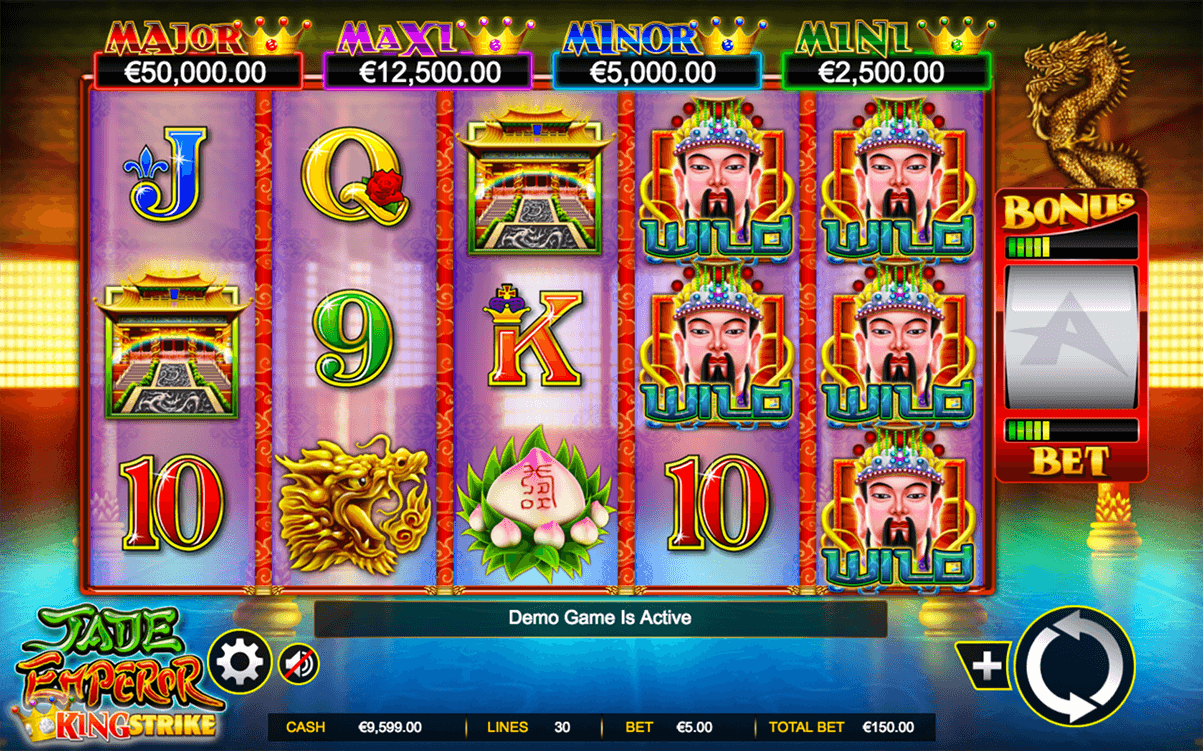

Jika Anda mencari tempat untuk berjudi online, Sbobet adalah salah satu tempat terbaik untuk memulai. Situs ini memiliki berbagai macam permainan dan menawarkan kesempatan untuk memenangkan hadiah besar. Juga mudah untuk menyetor dan menarik uang. Selain itu, Sbobet menerima pemain dari seluruh dunia.

Perangkat lunaknya ramah pengguna dan situs webnya sangat bersih dan teratur. Mudah dinavigasi dan Anda dapat mengakses banyak tutorial berbeda. Hadiah yang bisa Anda dapatkan juga menarik.

Pembayaran SBOBET cepat dan batas taruhannya termasuk yang tertinggi di Asia. Situs ini menggunakan Random Number Generator (RNG) untuk memastikan bahwa semua permainan adil dan jujur. Ini adalah aspek penting dari perjudian, dan menjadikan SBOBET pilihan yang aman dan andal untuk permainan daring. Selain itu, langkah-langkah keamanan situs termasuk yang paling maju di industri ini. Selain itu, layanan pelanggannya tersedia 24 jam sehari melalui telepon dan email.

Mudah menyetor uang

Sbobet adalah situs web kasino dan taruhan olahraga online yang menerima berbagai mata uang dan memudahkan untuk menyetor uang. Pengguna dapat menggunakan e-banking, M-banking, dan transfer ATM untuk mendanai akun mereka atau menarik kemenangan. Situs ini juga menawarkan berbagai permainan dan agen yang membantu bagi pemain yang memiliki pertanyaan.

SBObet juga menawarkan pembayaran seluler, yang nyaman bagi mereka yang sedang bepergian. Layanan ini tidak tersedia di semua negara dan penyedia seluler, tetapi merupakan cara yang bagus untuk menyetor uang dan bermain tanpa harus meninggalkan rumah.

Namun, penting untuk diingat bahwa perjudian bisa membuat ketagihan dan Anda harus selalu berjudi dengan bertanggung jawab. Merupakan ide bagus untuk tetap berpegang pada anggaran Anda dan hanya bertaruh dengan uang yang Anda mampu untuk kehilangannya. Dukungan pelanggan di Sbobet tersedia melalui email, telepon, dan Skype. Mereka tersedia sepanjang waktu dan akan membantu Anda dengan masalah yang mungkin Anda miliki.

Mudah menarik uang

SBOBET memiliki berbagai permainan kasino dan olahraga yang menyenangkan dan imersif. Mereka juga menawarkan promosi dan bonus untuk dimanfaatkan pemain. Ini termasuk bonus setoran pertama dan taruhan gratis. Ini dapat diterima melalui teks atau email, atau diberikan kepada pelanggan baru selama proses pendaftaran mereka.

SBobet adalah kasino online Asia yang mengutamakan keamanan pemain. Berlisensi di Filipina dan Isle of Man, situs ini memiliki reputasi adil dan aman. Situs web telah diuji untuk virus dan malware, dan menawarkan opsi pembayaran Bitcoin untuk keamanan tambahan.

Pemain dapat menghubungi dukungan pelanggan melalui email, telepon, atau obrolan langsung. Perusahaan juga memiliki blog dengan berita dan pilihan untuk penggemar olahraga. Ini adalah cara yang bagus untuk mengikuti taruhan olahraga terbaru. Sistem keuangannya juga sangat mudah digunakan dan tidak ada keluhan tentangnya. Ini juga menawarkan berbagai pilihan perbankan.

Dukungan pelanggan yang baik

SBOBET memiliki banyak cara bagi Anda untuk menghubungi mereka jika Anda memiliki masalah. Anda dapat menggunakan email, saluran telepon untuk setiap benua, atau live chat mereka. Mereka juga menawarkan Skype, WeChat, dan WhatsApp sehingga Anda dapat berbicara dengan seseorang tanpa membayar panggilan atau SMS.

Hal lain yang membedakan SBObet dari beberapa pesaingnya adalah fitur live streaming untuk acara olahraga besar. Ini adalah cara yang bagus untuk lebih terlibat dengan permainan yang Anda pertaruhkan.

Sbobet adalah sportsbook yang populer, tetapi mereka pernah mengalami beberapa masalah di masa lalu. Pada 2008 dan 2009, mereka dituduh mengatur pertandingan, tetapi mereka menolak memberikan informasi apa pun tentang pelanggan mereka, yang merupakan langkah cerdas. Sejak itu mereka menghindari masalah serupa. Mereka juga menyediakan berbagai jenis permainan dan opsi taruhan yang bagus. Mereka bahkan memiliki beberapa fasilitas untuk pemain baru seperti live streaming pertandingan gratis.…